Understanding Insurance: A Comprehensive Guide*

Insurance is a financial safety net that protects individuals and businesses from unexpected losses. It plays a crucial role in providing financial stability and peace of mind. Whether it’s for health, life, property, or business, insurance helps mitigate risks and ensures that people can recover from unfortunate events without bearing the full financial burden.

What is Insurance?

Insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays regular payments called premiums, and in return, the insurance company promises to cover certain losses or damages as outlined in the policy. This agreement provides financial protection against risks such as accidents, illness, theft, or natural disasters.

Types of Insurance

There are several types of insurance, each designed to cover specific risks:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescription medications.

- Life Insurance: Provides a lump sum payment to the beneficiary in case of the policyholder’s death.

- Auto Insurance: Protects against financial loss from vehicle-related accidents or theft.

- Home Insurance: Covers damages to the home and personal belongings due to fire, theft, or natural disasters.

- Travel Insurance: Offers coverage for trip cancellations, lost luggage, or medical emergencies while traveling.

- Business Insurance: Protects businesses against property damage, lawsuits, or employee-related risks.

Why is Insurance Important?

Insurance is essential because it provides financial security during difficult times. Without insurance, paying for medical bills, car repairs, or rebuilding a home after a disaster could be overwhelming. It helps individuals and businesses recover quickly from setbacks without draining their savings.

Additionally, insurance encourages responsible financial planning. It ensures that families are protected from unexpected expenses, and businesses can continue operating despite losses.

How Does Insurance Work?

The process of insurance typically involves:

- Choosing a Policy: The policyholder selects a policy based on their needs and budget.

- Paying Premiums: Regular payments are made to keep the policy active.

- Filing a Claim: If a covered event occurs, the policyholder files a claim with the insurance company.

- Claim Evaluation: The insurance company reviews the claim and assesses the damages.

- Payout: If approved, the insurance company compensates the policyholder according to the policy terms.

Factors Affecting Insurance Premiums

Several factors influence the cost of insurance premiums, including:

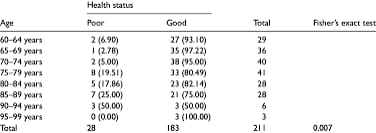

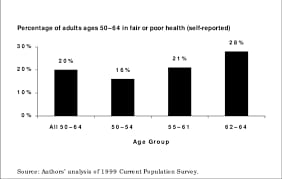

- Age and health status

- Type of coverage

- Location

- Credit score

- Claims history

- Lifestyle habits

Conclusion

Insurance is a vital part of financial planning that offers protection against unforeseen risks. It not only provides peace of mind but also ensures financial stability for individuals, families, and businesses. Understanding the different types of insurance and choosing the right coverage can help safeguard your future and provide a safety net in times of need. Whether it’s health, life, or property insurance, having the right policy can make a significant difference in your overall financial well-being.